Some Ideas on Top Tulsa Bankruptcy Lawyers You Should Know

Some Ideas on Top Tulsa Bankruptcy Lawyers You Should Know

Blog Article

4 Simple Techniques For Best Bankruptcy Attorney Tulsa

Table of ContentsGetting My Top-rated Bankruptcy Attorney Tulsa Ok To WorkThe 10-Minute Rule for Bankruptcy Attorney TulsaHow Which Type Of Bankruptcy Should You File can Save You Time, Stress, and Money.Rumored Buzz on Bankruptcy Attorney Near Me TulsaThe Best Strategy To Use For Tulsa Bankruptcy Attorney

The stats for the various other major type, Phase 13, are also worse for pro se filers. Suffice it to say, talk with a lawyer or 2 near you who's experienced with bankruptcy regulation.Several attorneys additionally provide totally free consultations or email Q&A s. Take benefit of that. Ask them if personal bankruptcy is certainly the appropriate option for your circumstance and whether they believe you'll qualify.

Advertisement Now that you have actually determined personal bankruptcy is certainly the appropriate course of action and you with any luck removed it with an attorney you'll need to get started on the paperwork. Before you dive right into all the main insolvency types, you need to obtain your own files in order.

An Unbiased View of Tulsa Ok Bankruptcy Attorney

Later on down the line, you'll in fact need to verify that by disclosing all kinds of details regarding your economic affairs. Right here's a standard listing of what you'll require when traveling in advance: Determining papers like your vehicle driver's certificate and Social Safety card Tax returns (up to the previous 4 years) Proof of income (pay stubs, W-2s, self-employed profits, income from assets along with any income from government benefits) Bank statements and/or pension statements Proof of worth of your properties, such as automobile and realty evaluation.

You'll want to understand what kind of debt you're trying to deal with.

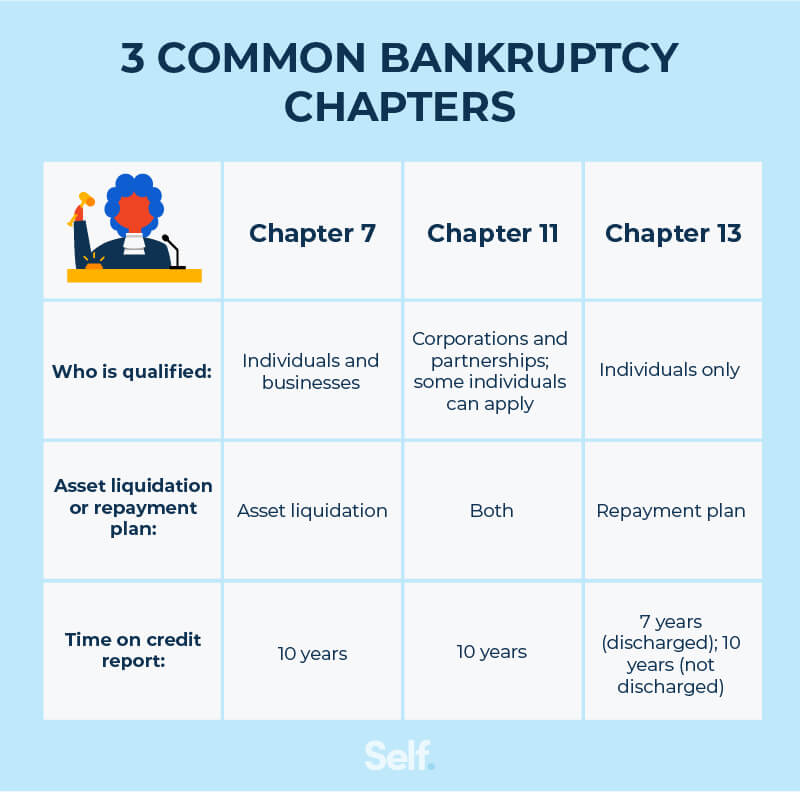

You'll want to understand what kind of debt you're trying to deal with.If your income is as well high, you have one more choice: Chapter 13. This alternative takes longer to solve your financial debts since it calls for a lasting settlement strategy typically three to 5 years prior to a few of your remaining debts are wiped away. The filing procedure is additionally a great deal more complicated than Phase 7.

Some Known Factual Statements About Chapter 13 Bankruptcy Lawyer Tulsa

A Phase 7 bankruptcy remains on your credit history record for 10 years, whereas a Phase 13 bankruptcy diminishes after 7. Both have long lasting effects on your credit history, and any kind of new financial debt you secure will likely come with greater rate of interest. Prior to you submit your personal bankruptcy types, you need to initially complete a compulsory program from a credit counseling firm that has been accepted by Get the facts the Division of Justice (with the remarkable exception of filers in Alabama or North Carolina).

The training course can be completed online, personally or over the phone. Courses normally cost between $15 and $50. You have to complete the program within 180 days of declare bankruptcy (Tulsa OK bankruptcy attorney). Make use of the Division of Justice's web site to find a program. If you reside in Alabama or North Carolina, you should Tulsa bankruptcy attorney select and finish a training course from a listing of separately authorized providers in your state.

Tulsa Bankruptcy Attorney Fundamentals Explained

Inspect that you're submitting with the correct one based on where you live. If your copyright has actually relocated within 180 days of filling, you should submit in the district where you lived the greater section of that 180-day period.

Normally, your bankruptcy lawyer will certainly collaborate with the trustee, yet you may require to send the person records such as pay stubs, tax obligation returns, and financial institution account and credit score card statements straight. The trustee that was simply designated to your situation will certainly quickly establish a compulsory conference with you, referred to as the "341 meeting" due to the fact that it's a need of Area 341 of the U.S

You will need to give a timely checklist of what certifies as an exemption. Exemptions may put on non-luxury, main lorries; needed home products; and home equity (though these exemptions policies can vary commonly by state). Any property outside the checklist of exceptions is taken into consideration nonexempt, and if you do not give any checklist, then all your residential property is taken into consideration nonexempt, i.e.

You will need to give a timely checklist of what certifies as an exemption. Exemptions may put on non-luxury, main lorries; needed home products; and home equity (though these exemptions policies can vary commonly by state). Any property outside the checklist of exceptions is taken into consideration nonexempt, and if you do not give any checklist, then all your residential property is taken into consideration nonexempt, i.e.The trustee would not offer your sporting activities automobile to immediately settle the lender. Instead, you would pay your creditors that quantity throughout your layaway plan. A typical mistaken belief with insolvency is that as soon as you file, you can quit paying your financial debts. While bankruptcy can aid you erase a lot of your unprotected financial obligations, such as past due clinical expenses or personal fundings, you'll wish to keep paying your monthly settlements for secured financial obligations if you intend to maintain the building.

Tulsa Ok Bankruptcy Attorney Things To Know Before You Buy

If you're at threat of foreclosure and have actually tired all various other financial-relief alternatives, after that applying for Chapter 13 might delay the foreclosure and assist in saving your home. Ultimately, you will certainly still need the income to continue making future home mortgage payments, in addition to repaying any type of late repayments over the course of your payment strategy.

If so, you may be needed to give added information. The audit might delay any type of debt alleviation by numerous weeks. Of training course, if the audit transforms up incorrect details, your case might be disregarded. All that stated, these are fairly rare instances. That you made it this much in the process is a good indication a minimum of several of your financial debts are qualified for discharge.

Report this page